how much is the nys star exemption

To qualify the adjusted gross income must be under the State specified limit for the required income tax year 500000 for Basic 86300 for Enhanced and is eligible for a yearly 2 increase in the tax savings. How much do you save with enhanced star.

The School Tax Relief Star Program Faq Ny State Senate

Those making between 250000 and 500000 will instead receive a check from New York State.

. 59 rows the star exemption amount multiplied by the school tax rate excluding any library levy portion divided by 1000. However STAR credits can rise as much as 2 percent annually. The total amount of school taxes owed prior to the STAR exemption is 4000.

How Much Is My Nys Star Exemption. New York mailed out advance payment of the Property Tax Freeze Property Tax Relief and STAR Credits to qualified taxpayersThe Property Tax Freeze Credit amount was based on the amount of increase in local property taxes on primary residence. Seniors will receive at least a 50000 exemption from the full value of their property.

In New York State the homestead exemption known as STAR for School Tax Relief allows homeowners in some counties to deduct as much as 1635 from their property taxes while those over 65 can deduct up to 2940. The total amount of school taxes owed prior to the STAR exemption is 4000. It is 35 for households with income between 150000 and 200000 and 105 for between 200000 and 275000.

It is possible to save 1000 annually via Enhanced STAR exemption savings. The Enhanced STAR exemption provides an increased benefit for the primary residence of a senior citizen age 65 and older who has a qualifying 2020 income of less than 92000. When the basic exemption is fully phased in they will receive at least a 30000 exemption from the full value of their property.

Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings of the prior year. STAR exemption amounts. New York State revised the filing and approval procedure for all Enhanced STAR applications beginning in the 201920 tax year December 2019 to.

Based on the first 70700 of the full value of a home for the 2021-2022 school year. How much is the nys star exemption. In this example 400 is the lowest of the three values from Steps 1 2 and 3.

70700 21123456 1000 149343. 5 rows If you are currently receiving STAR or E-STAR as a property tax exemption and you earn. Select your municipality and then scroll to your school district or.

The dates pertain to assessing units that publish their final assessment rolls on July 1. The Maximum Enhanced STAR exemption savings on our website is 1000. Basic STAR is for homeowners whose total household income is 500000 or less.

Call 311 Outside New York City call 212-NEW-YORK Nassau County residents Glen Cove residents should follow the general application instructions above STAR forms. While the maximum annual income eligibility requirement for Basic STAR remains unchanged at 500000 whats changed is that only those whose income is 250000 or less will be able to continue to receive exemptions on their property tax bill. The Enhanced STAR exemption amount is 70700 and the school tax rate is.

How much is NYS Enhanced STAR exemption. STAR lowers property taxes for eligible homeowners who live in New York State school districts. The total amount of school taxes owed prior to the STAR exemption is 4000.

A reduction on your school tax bill. Senior citizens also get a check. The Enhanced STAR exemption amount is 70700 and the school tax rate is 21123456 per thousand.

How much is NYS Enhanced STAR exemption. Exemption forms and applications. Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR exemption in the 2021-2022 school year is 70700 rather than 30000 for Basic STAR.

For those earning between 75000 and 150000 the rebate is 60 of what you receive in STAR. About 4000 dollars of school taxes were owed before STAR. HOW MUCH IS THE STAR exemption in NY.

You must register with NY State online at wwwtaxnygovstar or over the phone at 518-457-2036. The number 123456 is approximately ten thousand. How much will my STAR exemption check be.

88050 or less for the 2020-2021 school year 90550 or less for the 2021-2022 school year. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is 92000 or less. For instance if you live in Albany County in the City of Cohoes and your basic STAR exemption is 17340 and your homes assessment is 180000 you would subtract 17340 from 180000 to arrive at your homes value for local school property tax purposes of 162660.

For more information see STAR credit and exemption savings amounts. HOW MUCH IS THE STAR exemption in NY. The benefit is estimated to be a 293 tax reduction.

The Enhanced STAR exemption amount is 70700 and the school tax rate is 13123456 per thousand. 34 what they get from Enhanced STAR regardless of their income. The enhanced star exemption amount is 70700 and the school tax rate is 21123456 per thousand.

Provides an increased benefit for the primary residences of senior citizens age 65 and older with qualifying incomes. If youve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence. As long as you.

The enhanced STAR exemption will provide an average school property tax reduction of at least 45 percent annually for seniors living in median-priced homes. Over this year the Enhanced STAR exemption amount amounted to 70700 and there was a 13 per pupil school tax. The Maximum Enhanced STAR exemption savings on our website is 1000.

The formula below is used to calculate Basic STAR exemptions. The basic STAR exemption will be available to all residential property owners regardless of age or income starting in school year 1999-2000. You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less.

The Maximum Enhanced STAR exemption savings on our website is 1000. The Maximum Enhanced STAR exemption savings on our website is 1000.

Mary Kay Mesh Zipper Bag Set Up Mary Kay Party Mary Kay Consultant Mary Kay Facial

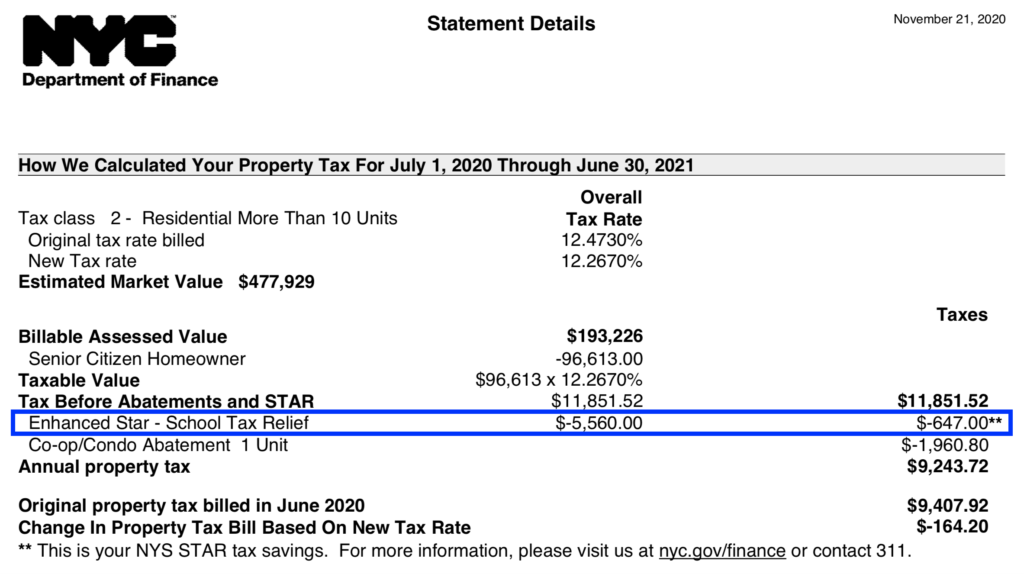

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Pin On Pictures Of Nursing Exhibition

Saturn V Markings John Duncan Saturn John Duncan Lettering

Lower Your School Taxes With The New York Star Program

Incident Report Form Report Template Police Report

Pin By Sean Baker Doran On Hot Cars Basic Income Hot Cars

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

The National Weather Service Has Issued A Winter Weather Advisory And Hazardous Weather Outlook For Long Island Winter Weather Advisory Winter Weather Weather

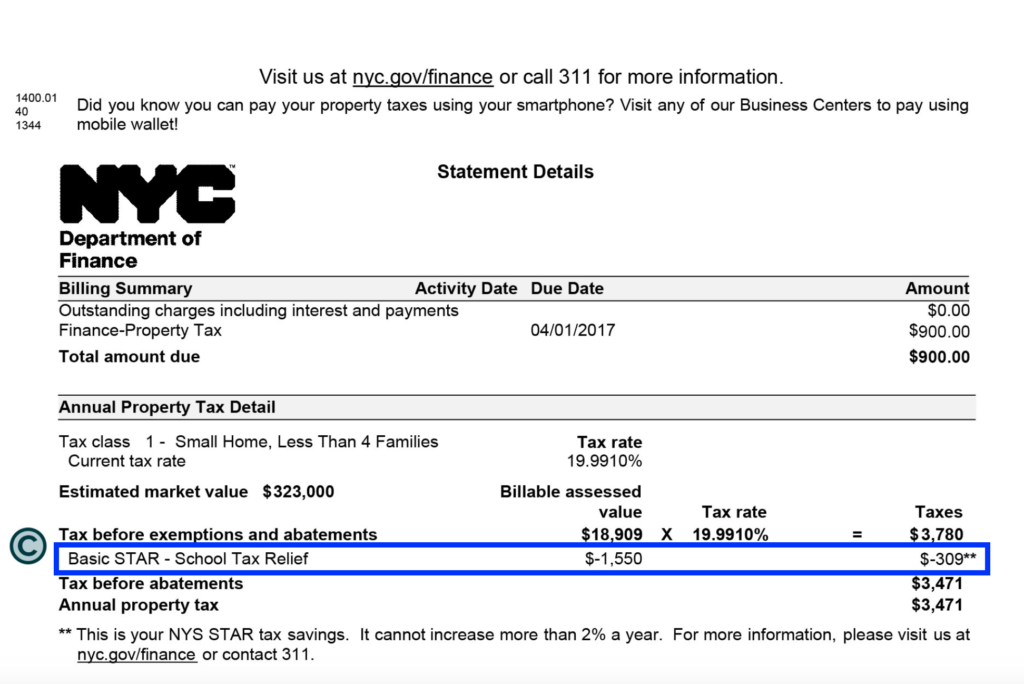

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Student Thesis Animation In 2021 Management Case Studies High School Story Change Management

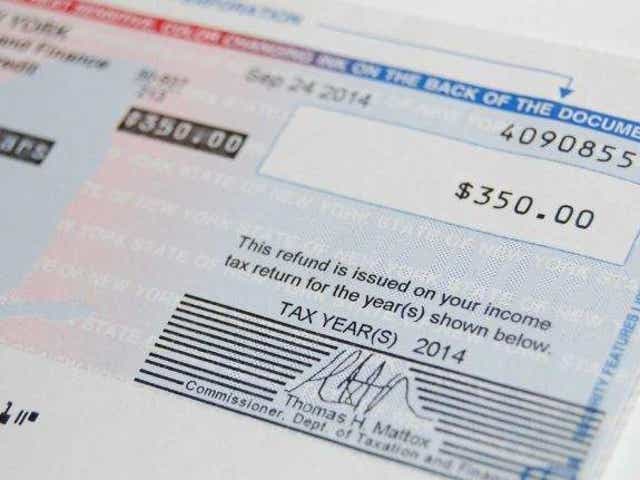

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

New York Seniors Reminded To Upgrade Star Exemption Rochesterfirst

Tax Rebate Program 480 A Forest Tax Law Nys Dept Of Environmental Conservation Environmental Conservation Law Tax

Lab Sling Psychrometer Earth Science Lab Student Work

Parties Selling Mary Kay Hostess Mary Kay Business Mary Kay Hostess Program

Many Homeowners Face A Choice On How To Best Get Their Star Wgrz Com